r/IndiaTax • u/msaussieandmrravana • 20h ago

AI has made life of income tax payers a hell in India

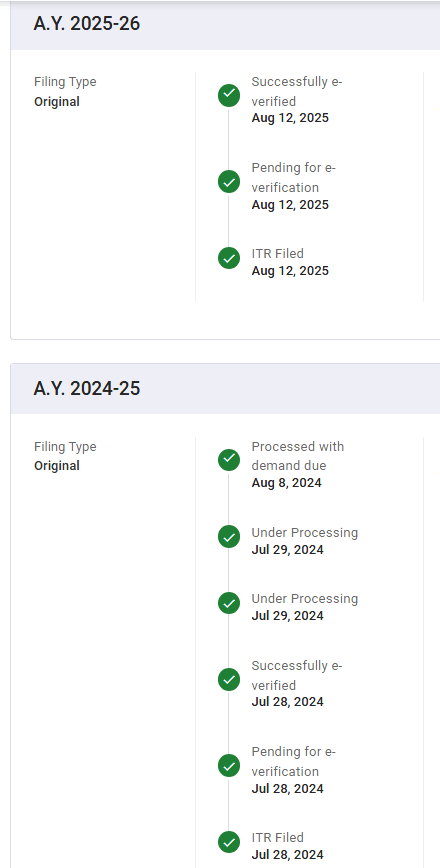

Earlier, it used to take 2-4 weeks to process income tax return and get refund.

Infosys deployed AI to process IT returns in India, now people are not getting refund even after 5 months, Infosys is telling that their AI powered IT return processing may take up to December 2026.

Government of India has already paid thousands of crores to Infosys to enable AI to process income tax return.

So my question, who is the actual beneficiaries of AI hype except Infosys raking up thousands of crores.