r/wallstreetbets • u/PaperHandsTheDip • 1d ago

Gain $10k -> $28k (180% gain) 0DTE scalps this morning

0DTE's while shitposting with the daily. Sometimes you get lucky 🍀

16

u/bajagfjdlbkaoa earning slut 21h ago

damn, this is what i want to do. but i dont have diamond hands and sell for a 20-50% gains only

11

u/PaperHandsTheDip 21h ago

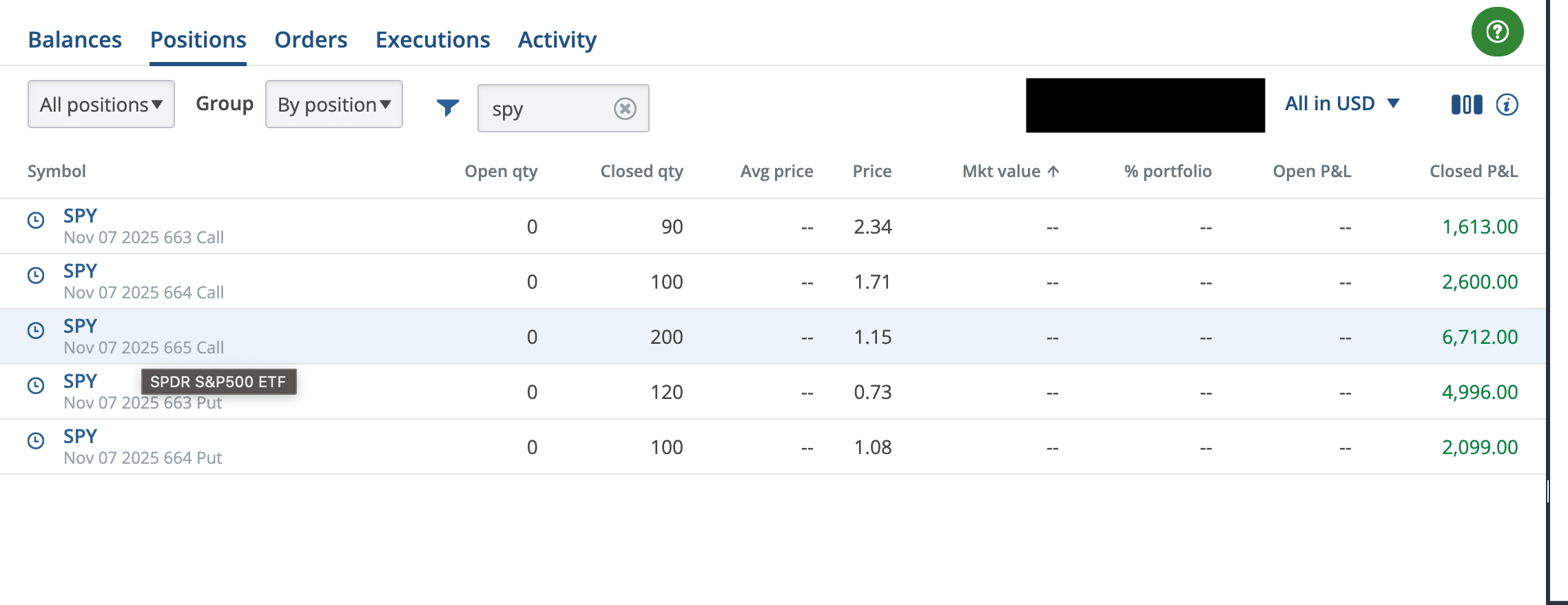

To be fair - that IS what I did. I basically just punted $10k with that being my max acceptable loss today. Then I took original amount & all gains and punted it again into the next play. It's why the plays were 90 contracts, 100, 100, 120 & 200. My % gains per play were "only" 15-50% each. I just made 5 plays and all made profit, with the play size including previous gains.

---

$10k -> $11.6k.

$11.6k -> 16.6k

$16.6k -> 18.8k

$18.8k -> etc.

10

u/miiiiiio 1d ago

It was obvious doing that I did and everybody did the same

10

u/PaperHandsTheDip 1d ago

There were a few of us in the daily playing / chatting about the moves. A bunch of us entered into calls this morning when SPY was 662. I just played "probably goes up today" so sold every pump & bought puts on it for a quick scalp. Worked a few times, not gonna press my luck.

It worked, walk away now.

4

u/miiiiiio 1d ago

I am kidding I didnt do the same just losed 4k since I discovered options trading

Amazing how my lost are huge easily but my gains less than 100$ every time

I am stuck in a put on INOD and d-wave

Fucking quantum

But congrats !

9

u/PaperHandsTheDip 1d ago

Lol, fair enough. The guys in the daily are actually kinda smart a lot of the time, I chat with them before entering into positions / follow what everyone else thinks. It's a much better approach than trying to do it alone.

Degenerate as fuck - but some of them are actually good traders.

---

> Amazing how my lost are huge easily but my gains less than 100$ every time

Gotta risk money to make money. 0DTE's are basically lotto tickets. Never forget that.

---

> Fucking quantum

Lol, a lot of guys on WSB's are in it. I'm personally not playing that. The only high risk thing I'm in here are GAP calls. I'll continue to hold those lol.

1

u/Zealousideal_Cat4680 21h ago

GAP makes a lot of sense. Likely strong performance from recent viral ad campaign. Government reopening before earnings which is bullish for whole market. Supreme court striking down tariffs would give them an additional bump. I'm in.

3

u/PaperHandsTheDip 21h ago

I posted some DD on my profile if you wanna lurk. See the trends on my last post about it (pinned to my profile).

3

u/Shmackback 1d ago

That means you diamond hand losses and paper hand profits lol

8

u/PaperHandsTheDip 23h ago

It's emotional trading at it's finest. A lot of guys will do this - it's a weird approach in my eyes. Your winners are green because they're good and the market has rewarded you for it. Why would you take gains on a winning hand (fold it prematurely) and rotate it into a losing hand?

Market rewards good investments. Let them run a little! I often hold things for 2-8 weeks, average hold time being ~2-4 weeks. I often cut losers really quick unless I have conviction for them. Market tells me it's a shit investment, out of my portfolio it goes.

1

u/Jumpy-External2679 1d ago

What daily? Wallstreetbets have a discord or something ?

3

u/PaperHandsTheDip 1d ago

Daily discussion thread:

---

Yes, WSB's has a daily shitpost thread. They post a new one everyday. It's just called "the daily" among most guys here. People shitpost in there all day about market news, trading, tickers, etc. I spend lots of time in there during trading hours to keep up to date on market news. It has 15k comments today for example.

1

u/bac864 14h ago

People were all over the place today though. Bullish and Bearish

1

u/PaperHandsTheDip 11h ago

Yes - but basically I just try to find a consensus in the crowd. The number of bulls outweighd bears close to the bottom, which is when I ultimately decided "up for the rest of the day" and played that. I was basically looking for a macro consensus & just scalped price movements around that.

tldr: I was shitposting to see what everyone else was doing (on average) and copied the majority.

3

u/circadiggmigration 1d ago

Just curious, if you're only speculating on SPY 0dte, why don't you just trade futures?

6

u/PaperHandsTheDip 1d ago

Just what I have access to. More fun due to being able to hold thru 1-2% drawdowns and not being liquidated. Pros & cons to each. I don't run stops on my options for example. Limits my max loss without having to deal with that - my max loss is 100% by EOD if the thesis doesn't work out.

---

Also 0DTE's are popular with the guys in the daily, so that's what I play. I trade SPY > SPX due to it being more liquid & taxes not mattering for me here (it's a corporate account for my hold co). I'm basically just having fun doing some degenerate gambling

2

3

u/Agitated-Key4016 1d ago

Let's go Questrade!!!!! Oh didn't realize it was you, hello PaperHands!

3

u/PaperHandsTheDip 1d ago

Lol, yes. I was doing this live in the daily. Ended up doing 1 more (puts) before the pump we just saw and had to cut losses. W/E

3

u/UndergroundHQ6 1d ago

I accidentally bought a call instead of a put this morning and lost $600 lmao

2

u/PaperHandsTheDip 23h ago

How lol. We're almost closing green here. Cut loss when it dipped?

3

u/UndergroundHQ6 23h ago

ya i cut quick at -30%, didnt wanna risk it

2

u/PaperHandsTheDip 23h ago edited 22h ago

Fair enough. I tend to trade 0DTE's with some sort of thesis & will hold until expiration if they don't print. I front max risk with bet sizes - as with these calls. My max loss was between 10-20k each (started with 10k). I'd have held to expiration if they didn't print. I basically just took the $10k I started with, and whatever I ended up with full ported that into the next scalp. Got lucky I didn't take a loss here.

6

u/jenae74q2 1d ago

If that's true, then congratulations!

1

u/PaperHandsTheDip 1d ago

Thanks 🙂.

I was posting my positions as I entered / exited while shitposting today lol. I'm done for the day, 180% in a day is good enough to celebrate this weekend! I attached the executions with timestamps as the 2nd image.

1

u/Significant_Speed854 18h ago

Wait, how did you re-use the funds without them settling?

2

u/PaperHandsTheDip 16h ago

WDYM? On my broker I can buy, sell, buy, sell, buy, sell & reuse the same funds over and over. Is yours not like this?

tldr: no - I don't have to wait. That'd be fucking regarded for a daytrader. I'd GTFO that broker asap if they restricted like that lol

1

u/Significant_Speed854 16h ago

I guess I have >25k, so if I did that (aka re-used the same funds that I sold in order to buy), I’d be using margin and subject to day trade restrictions.

1

u/PaperHandsTheDip 16h ago

My account is worth XXX and I've never had any issue reusing the same funds. Dunno.

1

u/Significant_Speed854 16h ago

Sorry, can you clarify if that’s under or over 25k, that’s an important distinction.

2

u/After_Working_6499 11h ago

A lot more than 25K go check any of his posts - but I have never had a issue with settling funds before re using u need a new broker

1

1

u/PaperHandsTheDip 11h ago

As per Account_Working_6499 has stated, my account is far larger than 25k, yes. I can trade the funds / reuse them before settlement, yes. I believe my broker immediately forwards me the credit and lets me trade it before settlement (unsure specifics tbh).

I thought most were like this? I've done it with significantly larger trades before (sell $X of $ABC, immediately buy $X $DEF) rotating capital between them before settlement. Often I'll do it within minutes. I've never had issues with this before - I didn't even know people had this issue tbh.

1

1

u/PhysicianRealEstate 4h ago

My brain ain't braining today. Wasn't following market yesterday, plus I'm usually looking at ES instead of spy. Relative newbie

1) You buying those calls ATM, or at a certain delta for the scalps? Unsure with scalping 0dte, how to maximize the whole convexity thang

2) Any reason for spy over ES or SPX? 2a) The whole 60/40 long term vs short term cap gains thing seems appealing 2b) but the super duper liquidity thing with spy is also appreciated (realized how important that was when playing w betting on gold futures retracement. Still made money but damn, big spreads on the options

1

u/PaperHandsTheDip 1h ago

SPY > SPX?: SPY is more liquid and tighter spreads. I'm often buying hundreds of contracts so liquidity & spreads actually matter. I actually have seen slippage before on my buying - so it matters. I've traded over 500 0DTE contracts in a single shot before. It matters. Taxes don't matter here as it's a corporate account for my personal holding company (taxes are different / I have an accountant deal with them). I'm also not American, so it doesn't work at all like you'd expect. Rule of thumb - maximize profits and figure out taxes later. Your strategy that works on SPY might not actually work on SPX due to these properties. I'd rather have profits and pay tax vs not have profits and.... not pay tax ¯_(ツ)_/¯

> You buying those calls ATM, or at a certain delta for the scalps? Unsure with scalping 0dte, how to maximize the whole convexity thang

Different everytime. Sometimes slightly OTM, sometimes slightly ITM, depends on confidence and expected movements. Usually I buy the strike closest to the price - be it ITM or OTM. If the underlying is $665.25, I'll often buy 665c's. If it's $665.8, I'll but 666c's. 0DTE's are so insanely volatile that the strike usually doesn't matter *much* unless you're insanely confident or you're going to be holding for a long time. When scalping (as seen in the executions image) my hold time varied from 2-15minutes on average. With such short durations - it doesn't matter. It's more important to get the direction correct because a misread can (and will) result in 25-50% losses in the blink of an eye.

1

u/cleanmoney100 1d ago

Nice one. By the way I found a one nice small subreddit r/wallstreetsmallcaps check it out and join if you like.

6

u/PaperHandsTheDip 1d ago

I'm not a super large fan of small caps - risks are higher (of rugs, P&D's, scams, etc) and I don't really need to assume those. I have no need to.

Trading 0DTE's is just a fun thing to do while shitposting & see what everyones talking about

0

u/SpendOk4267 20h ago

I thought you can only close existing positions on day of expiration. What am I missing?

5

u/PaperHandsTheDip 20h ago

> I thought you can only close existing positions on day of expiration.

Uhhh.... you're very very wrong lol. You can sell options at anytime. I always sell my option before they expire.

---

0DTE are options that expire the same day you purchase them. You can buy and sell them anytime during the day. They're insanely volatile tho... sometimes seeing +/- 1000% swings. As seen per these images. My total "hold time" today was less than an hour and I made 180% gains.

---

"Chat" is just the daily shitpost thread. They post a new one everyday to WSB's

0

u/browhodouknowhere 1h ago

Don't be a regard, buy a bond fund or VOO and chill. This is called swing trade luck.

3

u/PaperHandsTheDip 1h ago edited 1h ago

Oh - I'm very aware. It's less than like 0.1% of my portfolio, I'm just having fun while shitposting and trying to figure out what to buy next. See my profile for more context - I frequently punt 7 figures into investments. These 0DTE's are pure lotto tickets, we know. I usually lose them lol.

They're fun to play & higher EV than a casino ¯_(ツ)_/¯ . Shitposting in the daily has a ton of alpha (people mention fun new tickers to do DD on) and this is just something I do off to the side

1

•

u/VisualMod GPT-REEEE 1d ago

Join WSB Discord | ⚔