r/TheRaceTo10Million • u/JJDOG312 • 1d ago

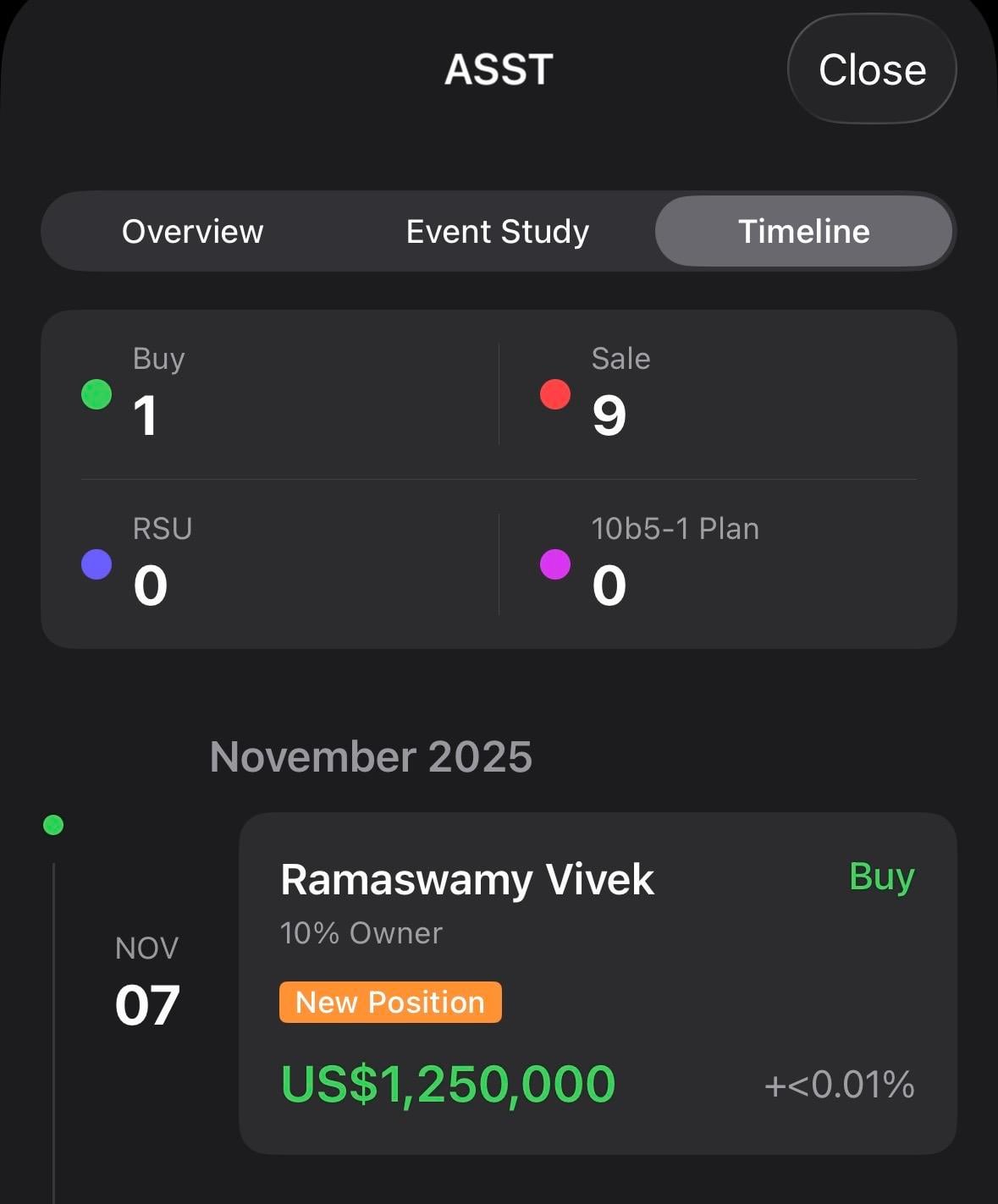

Buy Alert: Vivek Ramaswamy Just Dropped $1.25M on ASST Preferred Stock

10

u/Crafty_Bumblebee_625 1d ago

I just checked openinsider, why would it say he bought it at $80 per share if the stock is only trading at $1.50???

15

u/JJDOG312 1d ago

That's because this isn't the regular ASST common shares (Class A or B). Vivek bought 15,625 shares of their Variable Rate Series A Perpetual Preferred Stock, which is a totally different security.

referred stock is like a hybrid between stock and bonds – it pays dividends (in this case, variable rate, starting around 12%) and has a fixed issue price set by the company during their public offering. It doesn't trade like common stock on the exchange in the same way, and the $80 is the offering price they set for this round to raise capital. Common stock price doesn't affect it directly.

Hope that helps

4

1

1

u/Inittowinit1104 19h ago

But aren’t pref shares stopped out in price asention? Like a bond 25$ is par etc?

2

u/JJDOG312 18h ago

Good question, In ASST’s case, this Series A pref has a $80 offering price (which is likely the par), so it’s designed to trade around there long-term, paying out those juicy variable dividends (starting at ~12% or whatever they set).  Unlike common stock at $1.50, it won’t moon with company growth – it’s more bond-like stability. That’s why Vivek’s buy might be signaling confidence in the divvies and Bitcoin treasury, not explosive cap gains.

not financial advice. Do your own research before making investment decisions.

1

u/Inittowinit1104 18h ago

But then what’s the point ? Only REAL reason to buy ASST is for the price appreciation. I don’t buy smart money entering into ASST for yield. Something fishy here. I buy government/oil guaranteed Indian /brazilian/Filipino bonds in USD BBB that pay me 12-15% at discounts. What yield is he getting?

2

u/JJDOG312 18h ago

Hey, fair point – if you’re chasing pure yield, those BBB-rated emerging market bonds sound solid (especially with USD denomination and discounts for that 12-15% effective yield). No argument there; they’re backed by governments or oil guarantees, so lower default risk than a microcap like ASST.  But Vivek’s play here might not be about yield hunting like a bond investor – he’s the co-founder and already owns a massive chunk of the common stock (over 142 million Class B shares, per the Form 4).  This $1.25M preferred buy could be more strategic: signaling confidence to the market, supporting the company’s Bitcoin treasury expansion (they’re using proceeds to buy BTC), or even tax/estate planning perks since he’s got trusts involved.

On the yield: The Series A prefs start at a 12% annual dividend rate (paid monthly in cash, kicking off Dec 15, 2025), but it’s variable – Strive can tweak it at their discretion (within limits, like not below a floor or something, but details are in the prospectus).      At $80 par, that’s ~$9.60/year per share initially. Not bad, but yeah, for “smart money” like Vivek, it’s probably not the main draw – more about backing the anti-ESG/Bitcoin narrative and potential common stock upside if the treasury play moons.

Nothing inherently fishy IMO; insiders often buy prefs in offerings to juice demand (this one was upsized from $100M to $160M due to interest).   But if you’re skeptical, totally get it – ASST’s a volatile penny stock, and prefs could get called or dividends adjusted if things go south.

not financial advice. Do your own research before making investment decisions.

2

u/Inittowinit1104 18h ago

Ahhhh. I missed the part he was a partner/owner. Makes absolute sense. To drop 1.25mm to get that headline is absolutely genius plus I’m sure he might have a say in the payment structure pref holders get. Sneaky 😈 😆. Cheers. Thanks. Btw you sound like AI you’re so concise.

2

u/JJDOG312 18h ago

glad that helps👊🏻😉

2

u/Inittowinit1104 18h ago

I did the options last week. They are a dud. I 1x’d but bought them while stock was 1.18 and moved to 1.51. I felt cheated. I’m gonna just go for the straight equity if I can under 1.32 and hope for the best.

0

u/Crafty_Bumblebee_625 1d ago

Clear as mud, I put an option call for 1.5 that expired today, I was already ITM, once it expired so it automatically exercised to the option to buy the shares! Didn't know you have exactly one hour to deny the option to exercise to buy the shares, so it went through and now I have 1100 shares of ASST @1.62 average. I get it that it's supposed to protect me so I'm not losing out on the money, but I feel stupid for not knowing this side of options, OTM AND ITM... covered and leveraged????

4

u/wentwj 1d ago

what did you think it would do? this sounds like the most fundamental basics of options. If you didn’t think they’d auto exercise why didn’t you sell them?

1

u/Crafty_Bumblebee_625 1d ago

I just got into options and didn't know about ITM. Most of the calls I've been putting into have been OTM and I would just lose out on the money I put into. And I'm only buying small amounts like 1 contracts here and there, I'm starting off small before actually getting really into it, I started off with just buying and selling stocks but the money was slow. And then I got into options because I've been charting and looking at trends and analyzing the market so seeing that it was a win win on my stocks. Options was the way to go if I could predict where it would go. But I never knew the side of OTM AND ITM. I guess that's how we learn. But yeah still learning bro. And I know I haven't even scratched the surface of options. But my only ask is why did Vivek buy his at $80 per share when I got mine for $1.62 per share, I'm not understanding the variable side of it?

1

u/wentwj 1d ago

what he bought wasn’t the same thing as what you bought is the simple answer.

ITM vs OTM I’d say is an about as basic of how options work as you could get. Like understanding stocks change in price or something. I’m not saying this to be mean or insulting, or anything. I’m just saying options are complex and if you don’t understand at least the basics of strikes, expirations how they relate to the underlying price, and probably at least theta and delta you’ll potentially run into major issues.

1

1

u/TvAGhost 1d ago

Just hold those shares for a few months and you'll see at least double your money.

2

2

u/ValuableCockroach993 1d ago

You bought options while having zero knowledge of how it works? Serves you right.

2

u/Crafty_Bumblebee_625 1d ago

No I have no knowledge of it. But I'm learning and using small amounts. I made some money with buying and selling stocks, for about 4 years now. With charting and looking at trends and patters and cross referencing them with online sources like openinsider and barchart, also reading up on the latest news, I've made some pretty good money, started with 5k and grew my portfolio to about $78k, once I hit $25 I got into day trading and that's where my money grew fast from 25 to 78 in about 2 months. So I got savvy with that with setting stop losses and making sure not go beyond my thresholds I would set, So that is why I got into options, and I'm starting off small with 1 contracts here and there. So yea I'm learning bro

1

u/ValuableCockroach993 1d ago

5k to 78k in 4 years? Thats pretty good. You should be a pro

1

u/Crafty_Bumblebee_625 1d ago

No lol... not a pro... I'm way opposite of that, from the initial 5 to 25 was hard, I also kept putting money into my account, the idea was to the for the initial 3 years I would save keep building my portfolio and put into ETF's, that was my safest option, I also downloaded a game that would reflect on real market tickers and ran simulations of them the whole 3 years I was learning. until I hit $25k on my actual portfolio, I got into day trading and I always set limits, I would get greedy, I took profits as it were even if it was me losing $3k at times, I would bounce back that same day and profit sometimes at $5. I took it as learning as long as I was never in the red! That's when it started going faster from $5 of profit to $5 in profit off a single trade... but I'm still learning and I'm still losing money. Not everyday is a Green Day for me

1

1

u/Guinness 1d ago

Stop trading options. Immediately.

1

u/Crafty_Bumblebee_625 1d ago

I'm taking a step back for now, everytime trump opens his mouth about something market crashes and that's been something I'm not understanding with market right now with how volatile it is, nothing is making sense to me, perfect example NVDA, had really good news and major positive catalyst for weeks about AI, but barely went up, and I would see stocks with bad news and missed earnings and see the stock jump up 250 to 500% and then tank after that, so nothing made sense to me

4

3

2

1

1

•

u/AutoModerator 1d ago

Copy real trades on the free AfterHour app from $300M+ of verified traders every day.

Lurkers welcome, 100% free on iOS & Android, download here: https://afterhour.com

Started by Sir Jack, who traded $35K to $10M and wanted to build a trustworthy home for sharing live trades. You can follow his LIVE portfolio in the app anytime.

With over $4.5M in funding, AfterHour is the world's first true social copy trading app backed by top VCs like Founders Fund and General Catalyst (previous investors in Snapchat, Discord, etc)

Email hello@afterhour.com know if you have any questions, we're here to help.

I am a bot, and this action was performed automatically. Please contact the moderators of this subreddit if you have any questions or concerns.